Statement on Brokerage Services and Compensation

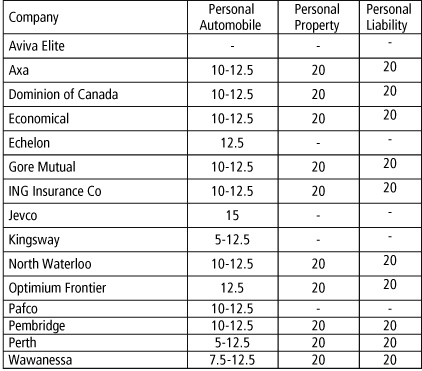

Personal

As your independent Insurance Broker, we purchase insurance products

and services on your behalf that are available, affordable

and understandable. Our role is to provide you with the best

insurance value that combines coverage, service and price.

We also provide personalized quality service that includes

professional insurance advice, ongoing policy maintenance and claims

support. When any issue arises regarding your insurance coverage, we

are your advocate, using our professional experience to best represent

your individual interest.Brokerage compensation is part of your insurance

premium. For your benefit, we have listed the Insurers that we represent

and have included the range of compensation each provides as a percentage

of your overall premium that appears on your invoice.

In addition to the Insurance Companies we represent under contract, as indicated above, W.L. Edwards Insurance Brokers Inc. will place risks with Specialty Markets when it is in our client’s best interest. In most cases, these specialty markets provide compensation at a lower rate than the Insurers we represent. In some cases, it may be necessary for us to charge a fee in lieu of or in addition to the commission payable under the insurance policy.

In these cases, we will

disclose both the fee and any commission payable under the

insurance policy.

In order for us to maintain strong relationships with quality

insurers, we work with each to provide the type of business

they desire. The insurers with an asterisk (*) recognize our

efforts through a Contingent Commission contract. Payment of this Contingent

Commission depends on a combination of profitability (loss

ratio), and / or growth (usually over a number of years) and / or increased

services that we provide on behalf of the Insurer.In some instances,

the occurrence of a few large losses on our book of business can disqualify

us from receiving a contingent profit payment for one or more years.

For detailed information on Contingent Commission, please go to the

individual company's website.

If you have any additional questions or require other information regarding any of the compensation received by W.L. Edwards Insurance Brokers Inc. for any of its insurance brokerage services, please do not hesitate to contact your account executive.

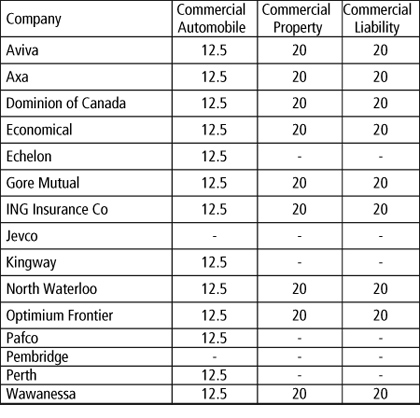

Commercial

As your independent Insurance Broker, we purchase insurance products

and services on your behalf that are available, affordable and understandable.

Our role is to provide you with the best insurance value that combines

coverage, service and price.

We also provide personalized quality service that includes

professional insurance advice, ongoing policy maintenance and

claims support. When any issue arises regarding your insurance coverage,

we are your advocate, using our professional experience to best represent

your individual interest.

Brokerage compensation is part of your insurance premium. For your benefit, we have listed the Insurers that we represent and have included the range of compensation each provides as a percentage of your overall premium that appears on your invoice.

In addition to the Insurance Companies we represent under contract,

as indicated above, W.L Edwards Insurance Brokers Ltd. will place

risks with Specialty Markets when it is in our client’s best interest.

In most cases, these specialty markets provide compensation at a lower

rate than the Insurers we represent. In some cases, it may be necessary

for us to charge a fee in lieu of or in addition to the commission payable

under the insurance policy.

In these cases, we will disclose both the fee and any commission

payable under the insurance policy.

In order for us to maintain strong relationships with quality

insurers, we work with each to provide the type of business

they desire. The insurers with an asterisk (*) recognize our efforts

through a Contingent Commission contract. Payment of this Contingent

Commission depends on a combination of profitability (loss ratio), and

/ or growth (usually over a number of years) and / or increased services

that we provide on behalf of the Insurer.

In some instances, the occurrence of a few large losses on our book of business can disqualify us from receiving a contingent profit payment for one or more years. For detailed information on Contingent Commission, please go to the individual company's website.

If you have any additional questions or require other information regarding any of the compensation received by W.L. Edwards Insurance Brokers Inc. for any of its insurance brokerage services, please do not hesitate to contact your account executive.